How to Classify CDP Vendors

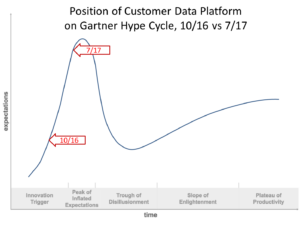

September 6, 2017Gartner’s latest Hype Cycle (August 2017) showed Customer Data Platforms moving from early innovation to near the top, a.k.a. “peak of inflated expectations.” That’s good news in some ways, although it also implies the next step is a slide down the “trough of disillusionment”. Sadly, that is a reasonable expectation: CDP has now attracted enough attention that we can expect to hear about bad experiences from companies who bought a CDP without understanding what to expect or preparing properly for deployment. As the hype cycle makes clear by its very existence, this is a normal though unpleasant stage in a category’s development.

The Gartner report also noted the confusion created by the variety of vendors using the CDP label. This is something we worry about a lot at the CDP Institute. The context is often a suggestion that we tighten our definition of CDP to exclude vendors without particular capabilities.

The idea has its attractions: in particular, it would give CDP buyers a clearer idea of what to expect. But I’ve so far chosen to take a “big tent” approach of including any vendor who meets the basic CDP requirements (marketer-driven, unified persistent customer database, shareable data) and has CDP as its primary product. (That last constraint excludes agencies and multi-product software vendors.) Arguments in favor of the more inclusive policy include:

– a wide variety of CDP configurations lets CDPs meet a wide variety of user needs. This means it’s more likely that marketers can find a CDP that is right for them. It’s better for everyone if marketers enter the CDP department store and find the right booth, than if they search randomly through the entire shopping district.

– CDP vendors came from many backgrounds but are becoming more similar over time. This is a normal development in any software category, as companies learn from each other and from customer needs. It’s true there’s a limit to how much most products can change without being fundamentally reengineered (which rarely happens). But many of the features cited as missing from some CDP products can be added without a full rebuild.

– vendors will use whatever terms they please. If companies find the CDP label attracts a productive stream of prospects, they’ll call themselves CDPs whether or not the Institute agrees. Maybe we could create a “seal of approval” that would carry some weight (more on that in a minute) but I’ve no illusions about our ultimate market power.

– more Institute sponsors means more Institute resources. It would be foolish to deny that growing the Institute has some appeal on its own. But more resources also lets us do more research, speak at more events, publish more papers, and do other things that educate buyers and promote the category. We’ve purposely kept the sponsorship fees low so we could attract many sponsors rather than be dependent on a few. That means expansion depends in good part on adding sponsors.

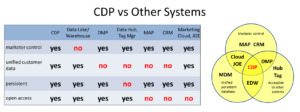

Nevertheless, it’s still clear that the variety of CDP vendors does create confusion about the category. The Institute has spent much of the past year working to clarify how CDPs different from other types of software that manage customer data. We’ve summarized that in the following chart and Venn diagram, used in many presentations:

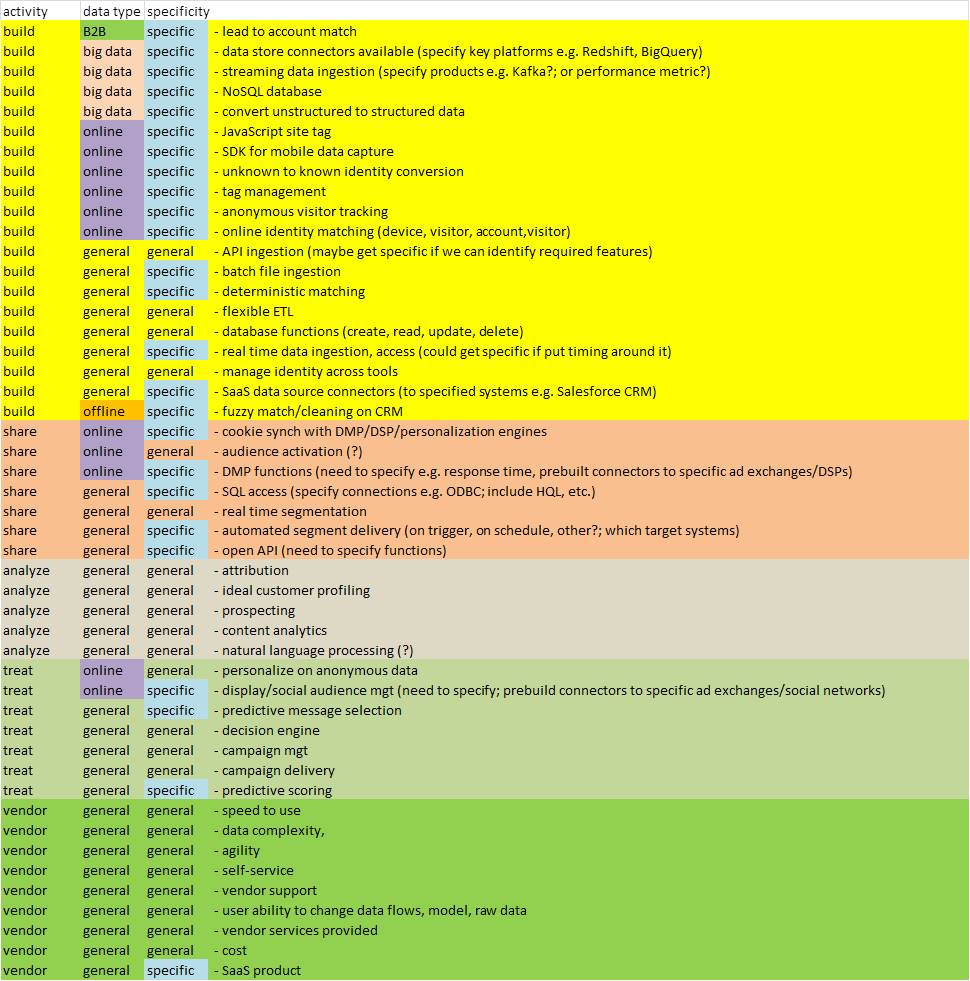

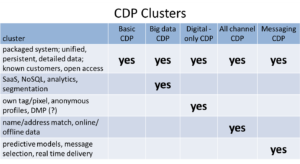

I think our next step is to work on establishing a similar understanding of differences between different types of CDPs. I’ve recently taken a tentative first step by defining clusters of features that belong to different subsets of the CDP universe. All CDPs support the first cluster, which is the core CDP definition itself. Many support at least one additional cluster and some support several. That means the clusters are more like building blocks than mutually exclusive categories. (In plainer terms: one CDP could fit several categories.)

You can also think of the clusters as checklist items – so once buyers know which vendors fit which clusters, they can match the clusters against their needs and have a relatively simple way to find the subset of CDPs that are worth exploring in detail. To continue our department store analogy, the clusters would be the signs pointing shoppers to the different departments. It’s still up to the buyers to look through the wares in each department to make a final choice.

It should still be obvious that vendors who qualify for a given cluster will still have major differences. And, of course, vendors would have every reason to claim they should be listed in a cluster as many clusters as possible. But it’s just possible that the CDP Institute carries enough authority that vendors would be willing to let us classify them – based on objective criteria, rigorously applied, of course. If we made agreeing to this a condition of Institute sponsorship, we might lose a few sponsors but I think the industry as a whole – including buyers – would be well served.

What do you think?