Personaliz(s)ation: Where to Focus?

September 6, 2018Is the EU a good place to invest and focus if you are a provider of personalization software and services?

Personalization is becoming a standard that all companies need to adopt to survive moving forward. It is a game changer that will shift $800 billion of revenue to the 15% of companies that get it right over the next five years, according to Boston Consulting Group1. In addition, 98% of marketers1 agree that personalization positively impacts customer relationships with the principal areas of benefit coming from increased visitor engagement, improved customer experience and increased conversion rates.

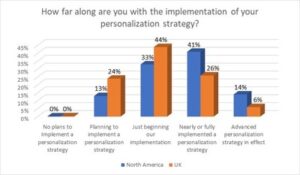

The quest for personalization is becoming an important capability for marketers globally and a high growth marketplace for organizations who offer personalization software and services. But, North American-based brands are twice as likely as EU-based brands to be more advanced in their personalization journey, according to Monetate1. With all this value driven from personalization, why is the EU not as advanced as the US? Should personalization software and services vendors focus on the EU? The answer to these questions depends on the state of personalization in EU. This report looks into that.

What is Personalization?

Gartner defines personalization as “a process that creates a relevant, individualized interaction between two parties designed to enhance the experience of the recipient. It uses insight based on the recipient’s personal data, as well as behavioral data about the actions of similar individuals, to deliver an experience to meet specific needs and preferences.”

What is the EU consumer’s attitude towards personalization?

Let’s start with customer behaviors. Personalization is proving to be a lucrative opportunity for EU retailers. It has proven to lead to impulse buys. In a recent EU personalization market report from Segment2, 59% of EU shoppers said in the past three months a personalized offer led them to purchase a product that they didn’t initially intend to buy. In addition, 20% more EU shoppers were likely to make an impulse buy based on a personalized recommendation than shoppers in the US. Overall, 40% of EU consumers say they have purchased something more expensive than they originally planned to because their experience was personalized and 65% report being satisfied with their last-minute purchases.

Despite the opportunity, only 34% of EU consumers expect highly personalized experience when they shop. More consistent personalization should improve results, so long as recommendations are accurate.

How do EU marketers compare with marketers elsewhere in their approach to personalization?

One way to understand the EU personalization market potential is to compare EU marketers to others elsewhere. We’ll look at this from angles including (1) the sophistication of the current martech stack, (2) level of Machine Learning, (3) level of Attribution, (4) level of data analysis sophistication and (4) adoption of buy online and pick up in store (BOPIS) and (5) and level of martech spend.

· Marketing technology. EU marketers are less confident in their tech stacks than US marketers. According to Salesforce3, over 70% of marketers in US say their current tech stack is extremely or very effective at increasing productivity by delivering better analytic insights, providing more cohesive view of customer data and delivering more efficient marketing spending. Just 60% in EU of marketers make similar claims. A 10% difference is significant.

· Machine learning. Monetate’s1 research has shown that UK companies are several months behind their peers in the United States in adopting machine learning. This is likely a reflection of different data privacy policies and consumer expectations, but also the adoption stage of personalization in the United Kingdom and elsewhere in the EU. European marketers are less likely to have a documented plan or dedicated budget than their counterparts in US. We expect the gap on machine learning to close over time. This provides a unique opportunity in the EU with a high propensity for growth in personalization adoption.

Monetate, 2nd Annual Personalization Development Study

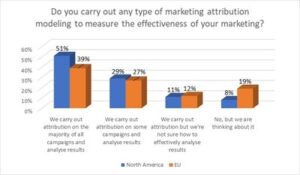

· Attribution. Marketing attribution is another indicator of personalization readiness. A recent Adroll attribution4 study found that North American and EU marketers agree that attribution allows better allocation of budgets across channels. But 51% of American companies were actually using attribution on most or all of their campaigns, compared with just 39% of EU companies. The study also reports that North American marketers and analysts are more than twice as likely to say that their systems are ‘very flexible’, suggesting greater confidence in their attribution tools.

The good news is that Europeans see the value of attribution. In fact, 71% in EU vs 55% in US believe that a better understanding of how digital channels work together is a benefit of marketing attribution. This is more evidence that the EU is a ripe marketplace for personalization.

AdRoll, State of Marketing Attribution 2017

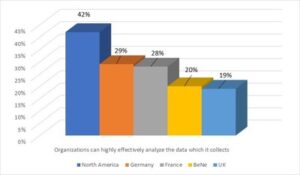

· Analytics. One the main capabilities required to drive personalization is the ability to analyze the data an organization collects from all channels. This is another area where EU companies lag the U.S. In a recent Gemalto study5, 42% of North American respondents believe their organization can highly effectively analyze the data that it collects. Figures from EU countries ranged from 29% in Germany to 19% in the UK, with France and BeNeLux in between. Clearly there is room for improvement for the majority of organizations when it comes to analyzing data – if they can’t analyze it effectively, then they may as well not collect it at all. The EU region’s inadequacies to effectively analyze data pose another obstacle to expanded personalization and a good opportunity for personalization services and software firms to drive value.

Gemalto, Data Security Confidence Index Report, 2017

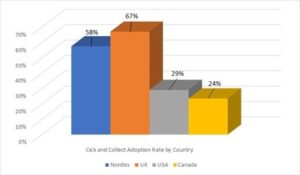

· Omni-channel retail. Omni-channel personalization grows revenue. The EU is actually ahead of U.S. retailers in the pocket of omni-channel retail capability known as BOPIS (Buy Online and Pick up In Store). A recent Order Dynamics Global Omni 10006 study found higher levels of BOPIS capability in UK and Nordic countries than in the US and Canada. BOPIS can be an important revenue driver because it provides consumers with greater flexibility and options. These positive results show the potential value from further personalization investment across all sectors in the EU.

Order Dynamics Research, Omni-1000 Research: Global

· Technology spend. Another reason the EU is has a great potential for growth is that the EU marketers are actually spending a larger share of their budget on marketing technologies. A recent study by Moore Stephens7 found that martech consumed 18% of the average EU marketing budget compared with 14% in the U.S. This is mostly due to a higher propensity to outsourced marketing spend rather than build in-house. This is good news for personalization software and services wanting to invest in the EU.

Summary Findings

The EU provides a growth opportunity for personalization software and services vendors. Although the EU marketer is behind the US in many areas, the time is now for EU brands to start really driving personalization initiatives to surprise and delight their customers with accurate, one-to-one personalization. EU brands that adopt personalization have proven it to be extremely effective.

There are a few obstacles. The EU lags behind in marketing technology, machine learning, attribution, and analytics. These findings may seem to show there are foundational obstacles that may delay the market in taking off. However, those that have adopted omni-channel retail have seen very positive results. In addition, the EU shows a willingness to invest in martech. All of this points to the EU having a potential for high growth in personalization.

With so much proven value that can be driven from personalization, this should be the immediate focus of all EU marketers. Thus, the EU personalization market has a higher propensity to likely grow faster than the US over next 12 – 18 months. There is already a precedent of a higher percentage of marketing dollars spent on martech solutions. This budget will be focused on personalization technologies which will become higher priorities than some of the other supporting marketing capabilities.

FOOTNOTES

1 Monetate, 2nd Annual Personalization Development Study, 2017

2 Segment, EU State of Personalisation Report, 2018

3 Salesforce Research, Fourth Annual State of Marketing, 2018

4 Adroll, State of Marketing Attribution, 2017

5 Gemalto, Data Security Confidence Index Report, 2018