The 360° Customer View – Dispel the Myth!

April 11, 2019Telco Customer Experience and Marketing teams are failing to make emotional connections with their customers. They are frustrated because they are unable to use all of their data to develop rich customer insights. To add to their frustration they see other companies using data in a more personalised and engaging way than they are – we call this the Great Competitive Paradox.

But do telcos have the key to find the Holy Grail – a complete view of the customer?

Local shopkeepers know their customers personally because they meet them and speak to them regularly. They build relationships based on familiarity and trust, and that makes doing business easier.

For the telcos, the challenge is to build a deeply human connection by generating insight about customers’ behaviour based on all the available data, not just the basic CRM and service data.

Making an accurate prediction of what customers want next might be difficult – but it’s not impossible. Let’s look at John, a customer. He’s a 44-year old man with an iPhone X and is on the 10GB data tariff. He spends $60 a month and has been with his service provider for four years. He lives in New York and has a low propensity to churn.

That tells us something, but it’s light years from a complete customer view.

Add a little more data and you discover he also has another contract for an iPad and a prepaid account. His iPad contract is the 1GB tariff and he tops up the prepaid account $10 every month.

Is this a ‘complete’ view?

What about other product lines? He doesn’t have any fixed-line services, but the address does. Third-party data tells us the household details and that John is married to Jane. Our data tells us that these services are in his wife’s name. So now we know John is married and the household view shows associated fixed and mobile services. This additional data indicates they have a child. Do we have a ‘complete’ view now?

What about adding some more data in our search for crystal clarity?

- Has John contacted his service provider in the last 12 months, visited the website or used the app?

- Has he responded to a customer satisfaction survey?

- Maybe he’s raised an issue, complained to the regulator or been on social media?

Let’s add all this data in, too.

So now we know his family and domestic arrangements, the phone he uses, how much he spends, and we have a somewhat blurry picture of his relationship with his service provider.

We can learn more. What about service usage? Perhaps John experiences higher than average dropped calls or maybe has a poor data experience. We should include this quality of service information because that will provide a view of his experience of the network. We have some good propensity models too – such as propensity to churn or Next Best Offer models. They are pretty accurate, so let’s add those in.

Have we yet got to the ‘complete’ view?

We know John’s participation in previous Marketing offers and also in our Loyalty or Reward scheme. We know which offers he clicked on and accepted or declined. He’s given us some personal information in exchange for Loyalty Scheme offers. We still haven’t reached the ‘complete’ view.

This level of customer insight is usually the best it gets for a typical telco. In the past, this level of understanding was ok, but the world has changed. This customer’s expectations have massively increased, pushed up by the FANGs of the world.

We need to add a lot more insight in order to gain a deeply human understanding of John and in turn give John a highly personalised customer experience.

We have the details of who John calls and messages and who calls or messages him in our billing records. We can use this information to identify key interests. We know what websites and apps he visits, so we can use that, too. There’s so much data here that could provide even more insight into John as a person rather than a commodity.

Data is fine, but understanding is the key to greater wallet share. You have to add meaning to the data; otherwise, it is useless. The fact that John frequently visits a website tells us little. Is it a coffee shop or a clothing retailer? If he calls a number, is it a ticket line for the cinema or is he calling a friend?

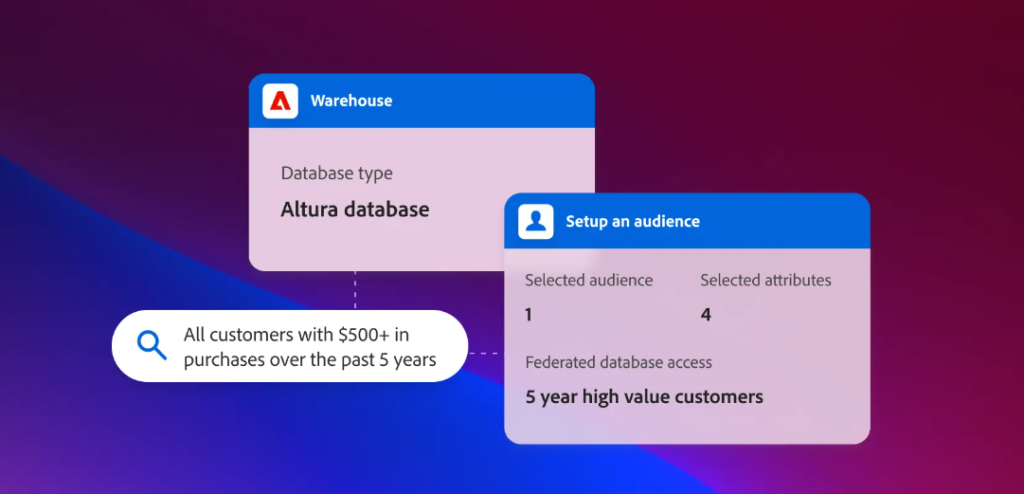

To really make sense of this cumbersome data, you have to be able to give it meaning; otherwise, it’s just a bunch of words and numbers. The key to all this is to process the data in a way that allows you to create a micro-database for each and every customer. You can add meaning to the data which in turn delivers a depth of insight never experienced before. Instead of knowing John frequently visits the usual suspects in terms of websites, you now know he has interests and brand preferences. He likes coffee, football, dogs and Formula 1 racing. You know he’s interacting with your competitors and he’s looking to move house.

Once you understand the behaviour, you can also infer attributes. Remember John has a prepaid account? The interests associated with this account are tennis, cosmetics and university. Targeting a football-related loyalty offer to this customer is not going to be successful. The behaviour suggests an 18-22-year-old female, probably their daughter, and John pays for her account.

Now you have a human-like understanding of your customer, for all your millions of customers.

You can micro-segment like never before, create tribes of customers with similar behaviour and target with enormous precision to deliver a 1-2-1 personalised experience. This means no more spam. Now you are processing your data and giving it meaning. The profile is as complete as your data allows. Maybe now you can say you do have a 360° view of your customer, and maybe now you can say you have a deeply human understanding of them.

See how O2 have started to challenge the Great Competitive paradox link here.

Contact me at mark.hiseman@intenthq.com to learn more about human-like 360° profiles.