The Omniscience Option: Next-best-action Recommendations that Work

April 23, 2020What marketer wouldn’t want to be omniscient, especially when it comes to understanding customers? Unfortunately, it’s not yet a martech option, but next-best-action prediction is as close to omniscience as marketers are likely to get in this lifetime. Its purpose is to use data-driven insights and analytics to predict the next action to take, whether the application is a customer service call or a marketing or social media campaign. Often called “next-best-action decisioning,” it’s been a marketing Holy Grail for a while.

But the difference lately is that predictive martech and analytics – fueled by advances in data lake technology, Customer Data Platforms (CDPs), and Big Data analytics – have gotten superbly good at it. So good, in fact, that “the omniscience option” is no longer a science fiction fantasy.

Next-best-action Helps You Market to Individual Customers

Next-best-action is uniquely suited to service, support, and marketing because it typically uses data from all of these functions. It focuses on specific customer preferences instead of positioning a product for larger nebulous groups of buyers. The idea is this: if you can accurately forecast what a buyer wants – exactly when they’re looking for it – and you can figure out how to reach them when they’re ready to engage, you can provide a great experience for them that improves sales and cements customer relationships. Plus, you also deliver all that at the lowest cost. It’s a win-win!

While easily explained in a blog, this vision is a bit harder to achieve in the field. It requires a lot of data about customer behavior, a real-time engagement feedback loop, and the power of prediction. These three capabilities alone are hard to solve, so you can imagine the challenge of putting them together into one seamless process, especially if you have to do all the technical work in your own organization.

While some marketers have prematurely written off next-best-action decisioning as an improbable application for customer analytics, other marketers are investing in the expertise and technologies they need to build next-best-action systems.

The Key Ingredients in a Next-best-action Recommendation System

The basics of next-best-action recommendations require marketers to understand what, where, and when buyer engagement happens. If this engagement is happening through digital channels – which is likely, given that 89 percent of buyers start their process of discovering products and services with a search engine – behavior becomes easily quantifiable. You get to understand what products visitors to your website are viewing and how many. You can determine their interest through numbers of clicks on a page or on an advertisement. As well, you can analyze patterns people display across channels (such as logins to mobile apps and number of previous in-store purchases), that signal they’re ready to purchase something.

With rich data sets that are unified around individual customers, the what, where, and when of engagement is ready for action. We’ll break them down for you in the next sections and dive into the technological capabilities to make “best actions” happen.

Campaign Activity Defines the What in Next-best-action Systems

For marketers, the “what” in next-best-action systems is defined by campaign activity. This is how marketers engage with buyers. So, when a marketer sends an email, delivers a message through an ad, or sends a promotion in the mail, they’re looking for a response. Maybe that response is a coupon redemption or click-to-download content.

Sometimes, a buyer’s response is to do nothing. This is important to know for next-best-action decisioning, so you need to ensure that your methods of aggregation can handle “null” values without a lot of translation and workarounds. No matter the reaction, what that buyer did (or didn’t do) to respond is going to determine what the next offer should be. Are you collecting what buyers do in response to your campaigns? And, where is all of that response data?

Most likely, that data lives in the systems you used for the individual campaign tactics – your email system, your social site, or your agency’s database. Some of it might be in your loyalty program database or point-of-sale systems. And, I’m going to bet that it’s not all in one place, unless you’re using a CDP, in which case you might already have a set of accurate, unified customer profiles.

The Where and When Requires Predictive Analytics

Once behaviors are analyzed and patterns are discovered, marketers can make some decisions about the next touchpoint. Do they want to retarget people who visited the site two or three times but never purchased anything? Do they want to send a follow-up email to people that stopped by their booth for samples? Maybe they want to do both, but when do they initiate the next touchpoint? Generally, marketers reach people by using a couple of different strategies:

- Where those people were when they responded (such as online or in the store)

- Where that marketer expects them to engage next based on a customer journey analysis

Both have their merits, but what’s really important is where and when a person is most likely to want to engage with your content, message, or offer. This is the context of “where” and “when” in the next-best-action recommendation system, and if the prediction is accurate, it can save you from unnecessary campaign activity and free up time for more meaningful projects.

Again, the details of your campaign data can be put to work here to help predict which channels matter the most to specific people and when they can be reached. Where do they respond and which channels do they ignore? Are they more likely to engage at night while they’re online? Through machine learning, daily or even hourly data can be analyzed to produce a channel propensity score. A high score represents a strong correlation to a particular channel (such as social site or email) and time. These scores can then be added to an individual buyer’s profile.

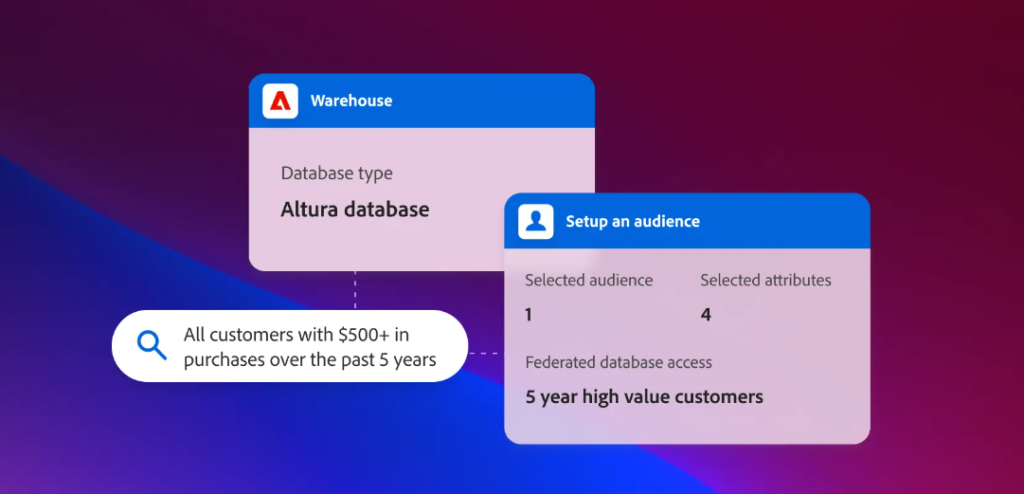

To use those scores, a marketer will need a way to discover individuals according to their behaviors (what) and their propensity to engage in a specific channel (where) and at what time (when). Just as they have for years with demographic and household data, marketers can use segmentation tools to discover people with similar behaviors and preferences. The process of audience segmentation is the same, save for one major adjustment; it requires the flow of large, fast moving data sets to place individuals into specific segments automatically.

Without the ability to dynamically segment people, using behavior as a basis for analysis would be very hard for marketers. Can you imagine the time you would need to discover when shoppers abandon their carts and sort them one by one into groups for your next email campaign?

Dynamic segmentation tools allow marketers to zero in on precise groups of people as they exhibit the behaviors to be followed up on, for example, all people who browse a site without purchasing. As well, marketers can use those tools to drill down further into where and when those same people are most likely to respond to another message, offer, or piece of content.

Putting the Next Best Action Pieces Together

Making next-best-action decisions requires the “what, when, and where of buyer engagement.” Marketers want to make smart choices to engage buyers, and they want to make those decisions quickly and effectively. There are important capabilities and knowledge needed to support the process of using behavioral data for next-best-action decisions. Here’s what you need to know to make the recommendation system work.

First, event-level data needs to be captured continuously and timestamped for understanding the sequences of those events. Visitor behavior on your website needs to be streamed in and organized alongside email and ad response data. This unification process isn’t trivial and requires data management expertise, but the outcome is an individual profile of every visitor, customer, and potential buyer. It reveals their behavior and when they exhibited good and bad responses (such as downloading content or abandoning a cart).

Second, machine learning algorithms can pick up on signals marketers wouldn’t be able to discover on their own. How likely a buyer is to engage in a given channel at a particular time can be more accurately determined by moving past frequency analysis to propensity modeling, which captures more data points based on how correlated they are to the behavior you want to predict. With greater accuracy, marketers make more confident decisions on where and when to engage a buyer.

And last, dynamic segmentation tools can automatically discover behaviors as soon as they’re exhibited and help marketers initiate communications, offers, and other touchpoints quickly. Propensity scores add key information about when and where to best reach people for the greatest impact. With scores and event-level details at their fingertips, marketers can get as granular as they’d like with their segmentation and target people with the best offers, in the right places, and at the optimal time. With greater precision, they can be more effective, fast.

For more on what makes next-best-action recommendations work, watch Become a Data Pioneer with Arm Treasure Data.