Creating a competitive advantage with a CDP: a guide for banks and telcos

November 4, 2021The pandemic has brought upon many digital-first innovations. It has accelerated omnichannel adoption — blending physical and digital commerce channels — as consumers quickly adopt digital-first interactions. Many of our customers now expect that we have digital-first offerings, which has brought immense pressure on banking and telco. We see this pressure mainly coming from digital-first & -native companies that have grown a lot in 2020; they were the big winners. Stock prices have risen through the roof. So, the traditional banks and telecom companies need to catch up.

Banking and telco are under pressure when it comes to leveraging customer data, but not always in the same way.

Why banks need to leverage customer data

1. The push of neobanks to put the customer first

Unlike traditional banks, neobanks have a robust customer-centric approach focusing on the customer journey and experience. At their core, neobanks are simple, flexible, and offer the low-cost products and services the customer wants.

Customer-facing neobanks mostly innovate around digital customer journeys and experiences by often un- and re-bundling traditional banking products to improve their product offerings.

By understanding customer needs, speeding up the time to market, and staying focused on their core value proposition, neobanks can easily control the end-customer experience.

2. Maximizing customer lifetime value

Customer lifetime value is one aspect of the customer journey that is impacted heavily by digital technologies. Customers in 2021 focus less on specific brands but are focusing on finding the right features and services that work for them.

So how can banks understand what the customer requirements are? And how can they provide customer-centric services?

Most traditional banks are moving towards digitalization, and accurate customer analytics act as an accelerator in this process. By leveraging customer analytics, banks can personalize their services to suit the customers’ needs as it provides real-time, accurate inputs.

3. Data-driven marketing for proactive engagements

Everyone is digital, especially your customers, and that’s where you need to be. Instead of waiting for them to contact you, you need to reach out to them, build relationships, and educate them. You can do this by sharing relevant content and your expertise as part of a solution to their challenges.

Customers want (and expect) highly targeted messages, which one can only achieve through a data-driven marketing strategy. It’s about being proactive in the way you help your customers, who use a wide range of channels to seek out support.

Regional differences

You can find this continuous tension between neobanks and traditional banks everywhere, and the way they deal with this is also similar across regions. In general, we notice that Asia is much more digital oriented than Europe, but more focused on digital touchpoint experience.

The difference lies in the offering: in Europe, they are evolving towards actual ‘marketplaces’ where banks try staying top-of-mind by offering much more than ‘only bank’ products. Which, of course, is accompanied by an even bigger need for data-driven insights. Because now, you’ll have to not only understand their “financial services and product needs” but also way broader the likes.

Telecoms challenges

When looking at the telecommunications industry, we see similar opportunities as they’re also sitting on a lot of data.

The sector is known for its many acquisitions to have a complete offering. The companies evolve, gather data, but they can’t reach that data as it’s all stored in scattered (product) silos. But if data is not centralized, you cannot deduct valuable and monetizable insights. And customers are even willing to pay for personalized experiences when used to be genuinely relevant and solve a problem.

Telecoms need to step up their game to unlock the value of data by getting rid of the silos, reorganizing their structure based on the customer instead of product- or flow-based, obtaining an end-to-end view on all touchpoints a consumer has with a brand, etc.

Differences between banks and telecoms

There are some significant differences between banks and telecoms as they’re all going through that process of maturing, with creating a unified customer view as the first step.

Banks have had more of a kickstart when it comes to customer data, and the quality is usually better as it often is more elaborate. With such customer knowledge, banks can better predict their customers’ needs and serve them on another level.

Both sectors, however, can benefit from using a customer data platform (CDP) to bring all that data together and act upon it. When it comes to MarTech, banks are often seen as risk-averse while telecoms are the ‘innovative ones.’ The beauty of a CDP is that it appeals to both types. On the one hand, because CDPs are very new and state of the art; on the other hand, because it is a technology that will add an intelligent layer on top. This means that you can start small and grow slowly, diminishing any risks and accelerating the first ROI.

Use cases that create an edge

It’s important to find a vendor who can help translate your business outcomes into a technology solution. The top 3 business goals we see with many clients is the following:

- Share of wallet: “How can we up- and cross-sell and get a share of the pie with each individual customer?”.

- Churn: depending on how high the risk of churn is, “Can we create a journey around that and predict when a customer is likely to churn?”.

- Engagement: as a business, you do not only want to have a selling relationship with your customers. Instead, you want to create an ongoing relationship with them. Many organizations are now looking into how they can create smart, ongoing engagement.

Create a competitive advantage with a CDP

With the proper CDP in place:

1) Banks can understand when to market and what they need to promote. They can then coordinate the campaigns with what the customer needs according to their journey or buying stage.

2) Banks can enhance the overall customer experience with precise customer insights, the right marketing strategy, and reduced risks.

Therefore, banks must prioritize improving and digitizing the customer experience and investing in getting an intelligent CDP. The right digital strategy with the right platform can strengthen the bank’s resilience and help when serving customers when they need it. When meeting customers at the right time, in the right place, with personalized recommendations, for instance, can decrease the everyday stress around financial matters and encourage users to trust the process and engage with the website or app.

Singaporean bank DBS invested heavily in all things digital and was well prepared for the sharp rise in demand for digital banking services during the COVID-19 crisis, resulting in being globally recognized as the best bank in 2020. Another noteworthy success of DBS is their DBS NAV Planner, which allows their customers to – among other features – receive real-time market prices to ensure their investments and to retrieve their financial information monthly to get an accurate view.

Time to go beyond tradition

Think of the way your customer is connected to you and how to build that relationship instead. We see it going in the right direction, though banks focus more on the individual than the product. So, it’s not necessarily about just selling the product anymore, but about sharing insights with their customers, taking up a trusted adviser’s role. From then on, they can start recommending towards a better financial situation.

A trend we notice is the gamification of spending and money management. Spending is, for instance, being gamified through goal-hitting use cases, and it’s all related to capturing mindshare instead of wallet share.

‘Start to invest’-services

Low threshold investments are a good example. We don’t just lower the ‘hurdle’ by offering lower investment amounts; we also make the portfolio as relatable as possible. Are you a car lover, then you can be sure there will be a car brand or a related company in the portfolio. Minimizing the unknown aspects is vital and is doable if you know your customer.

Services beyond banking

And this also goes for the new trend regarding marketplaces. Banks try to stay top-of-mind by offering more than only financial products and services. But they for sure want to avoid offering bus tickets to someone who is working from home or has a company car.

Individualized households

For telecoms, it’s more about the complexity of households and all the different people in them. You want to be relevant for every individual in that household. By what you offer and how you offer it, distinguish between the various devices used. It gets even more complex when taking into account who the actual decision-maker of the household is. This can be a sensitive issue and requires a lot of valuable customer data and intelligence.

Go further with an Intelligent Engagement Platform

The right tech is critical to achieving these use cases. Traditional marketing suites tend to fail at this, are mainly focused on execution, they don’t know how to handle data. So new tech solutions are needed to manage data, such as a CDP.

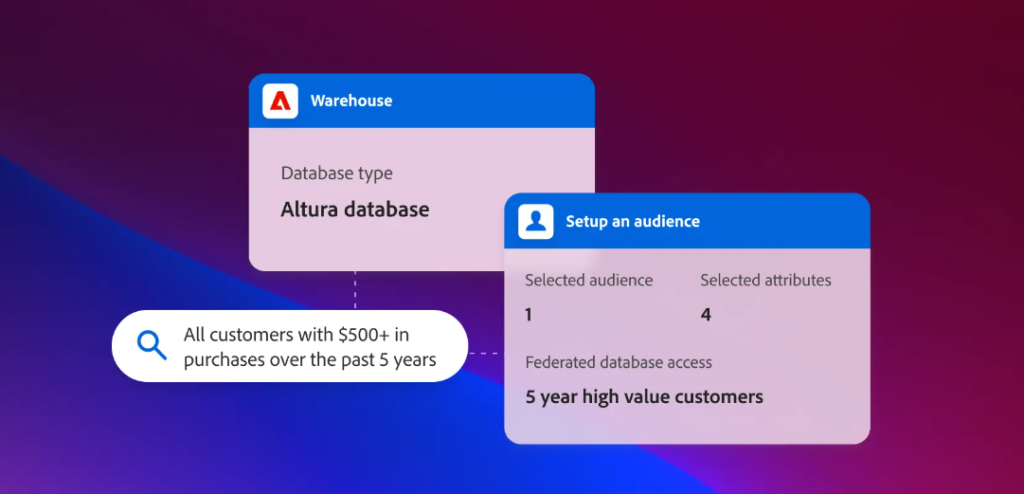

Managing customer data is one of the biggest challenges all companies/marketers face; that’s why a CDP is designed to solve the typical problems of integration, labeling, and customer data storage. Next to that, CDPs allow banks to have a unified view of all customer data interactions, thus granting more information to develop and execute strategies.

But NGDATA’s Intelligent Engagement Platform (IEP) goes beyond standard CDP functionality with access to fast, insightful, and actionable data. It’s intelligent because the IEP combines artificial intelligence and has in-built analytics to provide true 1-to-1 personalization across the customer lifecycle.

Our Customer DNA empowers you to produce the most insightful customer experiences. With real-time interaction management, marketers can engage with their customers in the channels they prefer with the most relevant messages.

Reduced contact center calls

An electric utility client needed help with reducing the pressure on their contact center. Every year, the company charges their customers monthly advanced payments. At the end of the year, they calculate each customer’s actual energy consumption. Some will be charged an additional cost; some will get a certain amount back. The company’s call center is being contacted a lot more frequently around that time, causing costs to go through the roof.

With a machine learning model, we found a way to predict these calls to prepare for them. The next step was to contact the customers before receiving that yearly bill, thus anticipating their questions and calls. By answering their questions before they could ask them, we could lower the pressure on the contact center significantly.

How to start with use cases

Start with basics.

Don’t overthink these futuristic use cases. Many companies started working with the technology in our space before the term ‘CDP’ was even invented. They have, of course, evolved by now and are looking at futuristic use cases. But we never recommend starting there. Start with the basics and grow from there: Who is your customer, and how can you serve him/her? Start small with one use case, measure the results and you can replicate, repackage, and re-bundle for other regions.

Allow yourself and your teams to get used to this new way of data-driven communication and mature together with the platform and your infra.

Dare to leap.

Once you get started, you’ll see it’s not as complex as it seems at first sight. Banks must learn to build products and services around a personalized, behavioral-based, journey-based view of their customers – essentially giving them what, when, and how they want it.

Leverage your CDP vendor’s industry expertise in combination with the lessons learned for their customers.

Think ahead.

Customer engagement cannot always be about new sales. The best way to engage your customers is to develop an experience based on their customer journey. Find out what your customers care about and design meaningful communications across all your online channels that mirror how you would build a relationship with a customer in person. Think of future use cases and then build towards them.

Dive deeper into this topic with NGDATA’s industry experts, contact us for a customized demo today.