How Apple did (not) kill a 330B$ industry

October 22, 2020After the big January blowout full of clickbait-ey headlines about Google killing cookies, (yes, for most marketers that’s still an open emotional wound) which we debunked for you here, we are in for another treat, my friends! Killing of IDFA this year.

What

…caused the upheaval was the announcement made at Apple’s July WWDC 2020 keynote. Apple revealed that come full rollout of iOS 14 this fall, they will be making changes to IDFA tracking and availability. Up until today this ID, which is used for marketing and advertising purposes such as targeting app users on ad networks or deeper user behaviour analytics inside of the app, was available to every app owner.

How are the user behaviour insights, metadata, and identifiers like the IDFA (Apple) or AID (Google, Android) being used of course grossly varies? On one side, you have brands who collect in-app user data and use it for better segmentation and understanding of customers and on the other side, you have thousands of free apps that sell your data to anyone who asks and trust me, a lot of companies in the ad tech ecosystem do ask.

Why

…would Apple do this? There are two aspects to this question and the latter will be highly speculative. But if you have a few seasons in the ad tech world under your belt, you would surely find it plausible.

First, the noble cause of user privacy. Apple has long been trying to position itself as a consumer privacy steward. The other option could be Apple’s fierce competition with their major frenemies, the tech giants, namely Google and Facebook who maintain a de facto duopoly on the advertising market at roughly 60% of the whole pie (US figures). They cooperate in some areas, compete in others and the digital advertising industry which is worth some 330 B$ annually is surely a strategic stake.

Who

…will be hit by this move? The truth is that the impact will be felt by the entire industry and all its key players. Everyone will have to change their strategy in the short term and their role in the ecosystem in the long term. But if we really have to take names, here goes:

- Advertising agencies – who may now find it difficult to build retargeting campaigns and therefore will be under pressure to deliver the results and positive ROI.

- DSPs – Without IDFAs of Android’s equivalent in the future, DSPs will be pressured to find alternative solutions, or have a hard time adapting, being unable to value their ad inventory, or filter out fraudulent devices. Targeting and attribution will be much harder.

- DMPs – With an Opt-In era beginning with the end of IDFAs, DMPs will no longer be able to anonymously collect and resell data, they first got toppled by loss of third-party cookies and what’s left in their data pools is data from long-tail free apps. This doesn’t apply to telco related DMPs in Asia as their data sources the telco network itself but that business model we anticipate will be soon under scrutiny due to changing data privacy regulations.

- Device graph providers – Companies who use device graphs can expect a significant loss of graph quality as a lot of them have been powered by the very app IDs we’re talking about here.

- Header bidding in programmatic – The unified auctions of ad inventory are reliant on ascribing a value to users, and thus reaching a price. But with this disappearing overnight, new processes may come into play.

How

…does this affect the world of Customer Data Platforms?

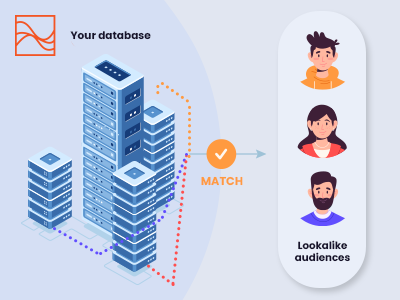

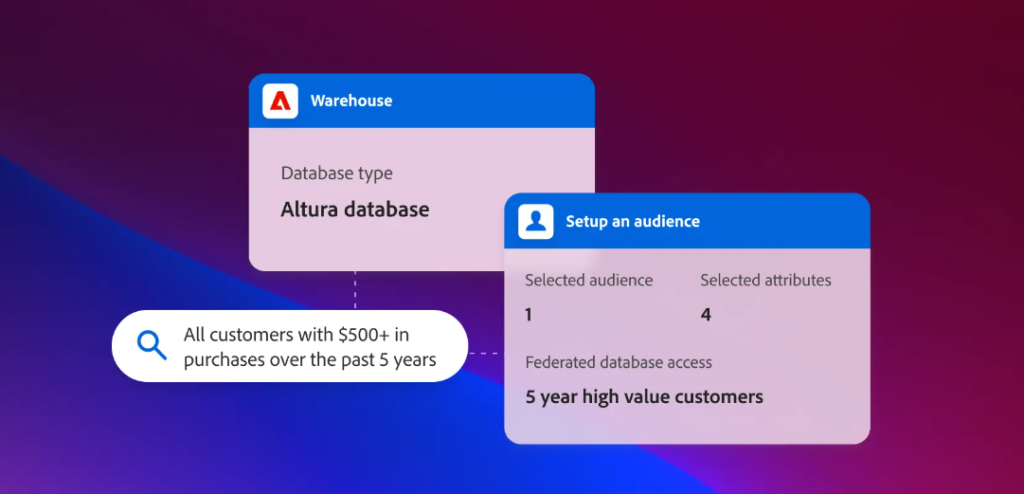

A lot, and yet – only a little. While the absence of IDFAs may be a loss of data, there are still other first-party data, typically PII based identifiers that CDPs use – in identity resolution i.e. persistent cookies, advertising app IDs, emails, and phone numbers, that aren’t really going anywhere. More identifiers per customer mean more options and opportunities for data activation. So what does the solution look like? By using these 1st party identifiers to build a comprehensive client profile using intelligent profile stitching, potentially enriched by third-party identifiers.

We are not cheesy enough to say that this situation will help CDP as a category overall since we are a CDP vendor, but if you read the market like that, who are we to argue?

What’s

…next for brands?

Despite the doomsday predictions, brands can still look forward to bright days ahead for digital marketing, albeit via different, more responsible, and transparent means. Are you curious about our suggestions on how to get ready for another digital marketing era?

You can finish this article on our blog, where you can find more info about the world of data, CDP, digital marketing and Meiro itself of course.