Delivering superior customer experience for banks with Terragon’s proprietary data and technology solutions

August 3, 2023From “product-centric to “customer-centric”

Banking to customers is variety of “ongoing services”, rather than a “product”; therefore, what really provides banks the competitive advantage are the innovative ways in which they can elevate customer experience and drive deeper engagement and consistent user experience across all channels. According to a Harvard Business Review survey, 64% of respondents from financial services companies say that improving CX is a top business priority.

The challenge and opportunity of data availability

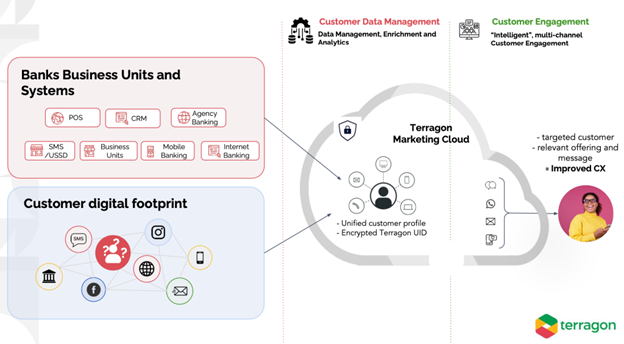

As customers interact with banks via multiple online and offline channels including physical branches, social media, call center, mobile, internet banking, USSD, WhatsApp etc, banks are presented with a tremendous wealth of customer data and insights on transactional behavior, preferences and interests that they (banks) can leverage, with the right technology to derive invaluable insights. The challenge however is the organization, structuring and enrichment of that data to gain actionable insights, in a way that ultimately improves customer experience (CX) and efficiencies; this is where banks in Africa have come to depend on Terragon’s unique customer data platform (CDP).

CDP + CPaaS Technology. The game changer

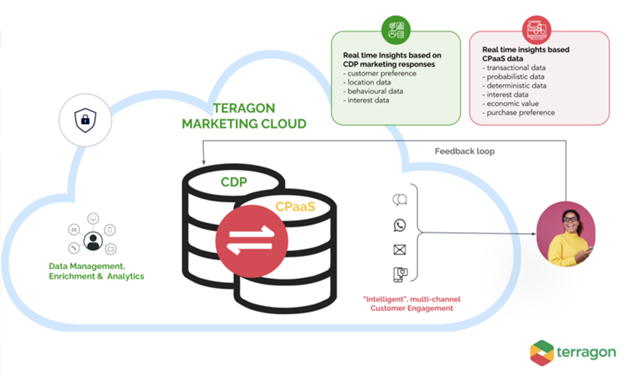

Customer Data Platforms (CDP) are not new to enterprises, though capabilities and market relevance differentiates one from the other. In its most basic definition, a CDP offers businesses a unified, 360-degree view of each customer. Its functionalities include “data management, robust analytics, data activation, data regulation compliance, and third-party systems integration”. One key feature that sets the Terragon CDP apart is the integration with our CPaaS (Communications platform as a Service) which takes “intelligent” omnichannel messaging to the next level; and has the potential to revolutionize customer engagement and drive adoption of new channels and digital behaviors for Banks and their customers.

Communications Platform as a Service (CPaaS) is a cloud-based solution which has reinvented how banks streamline their customer engagement across various channels including SMS, WhatsApp, voice and more. It enables bulk multi-channel messaging at scale for transaction alerts, notifications, identity and transactional authentication, customer support and more. “Gartner has predicted a huge surge in CPaaS adoption, with 90% of organizations turning to cloud-based technology by 2023, and IDC has estimated the market value for CPaaS to touch $17.7 billion by 2024.”

The Terragon CDP which combines the benefits of CPaaS multiplies the value it provides banks; by enabling stitching of customer profiles from multiple sources, data-driven marketing and the constant ingestion of insights based on customer interaction with CPaaS messaging back into the system to enrich the data; to help businesses improve efficiency, delight customers and reduce costs.

With this approach, customer engagement and messaging serve not just as a communication channel between banks and customers but also an invaluable source of customer insights as customer responses are fed back into the CDP providing real-time behavioral insights, generated by the customer to enable data-driven engagements at scale. This is as a result of Terragon’s proprietary technology which is built with robust data integration capabilities, AI and ML algorithm to process complex data from various sources – social media, CRM, transactional data etc to provide the insights required for real time decision meaning.

Big Data, analytics and cloud technology.

Consider the vast amount of data generated daily from transactions carried out by the 122.3 million active bank customers in Nigeria (Statista 2021); by simply checking their account balance and carrying out transactions – this is “big data”. Banks are able to harness this “big data” by using “data analytics” to translate data from its raw form into actionable insights. Analytics involves the use if specific techniques to gain deeper behavioral insights, identify common trends, mitigate risks and identify new opportunities; thereby allows banks to

- Mitigate risks by detecting and preventing fraud.

- Improve customer experiences by delivering more relevant and personalized offering and messaging to customers.

- Innovate by analyzing customer behavior patterns and developing new solutions to cater to customer need.

- Gain competitive advantage through data-driven strategy implementation and real-time decision making.

In order to process this “big data” more efficiently, Banks must begin to invest more in “cloud technology” as an alternative or complementary solution to local systems. Contrary to commonly touted concerns, cloud technology presents a number of advantages to banks including improved security and privacy compliance as it typically is built with a keen focus on security due to the sensitive nature of data. It enables quicker processing times for huge volumes of data and enables cost reduction and scalability.

The current disruptive wave of Artificial Intelligence (AI) e.g., ChatGPT etc. demonstrates the power and potential of Terragon’s CDP which leverages AI and ML (Machine Learning) to segment customers accurately and enable instances such as loan propensity scoring, next best action, churn prevention, product recommendations and more. For instance, a customer who makes a purchase of a travel ticket can automatically be offered travel insurance or currency exchange services, without any human intervention, thereby helping to save time and costs, resulting in increased profits.

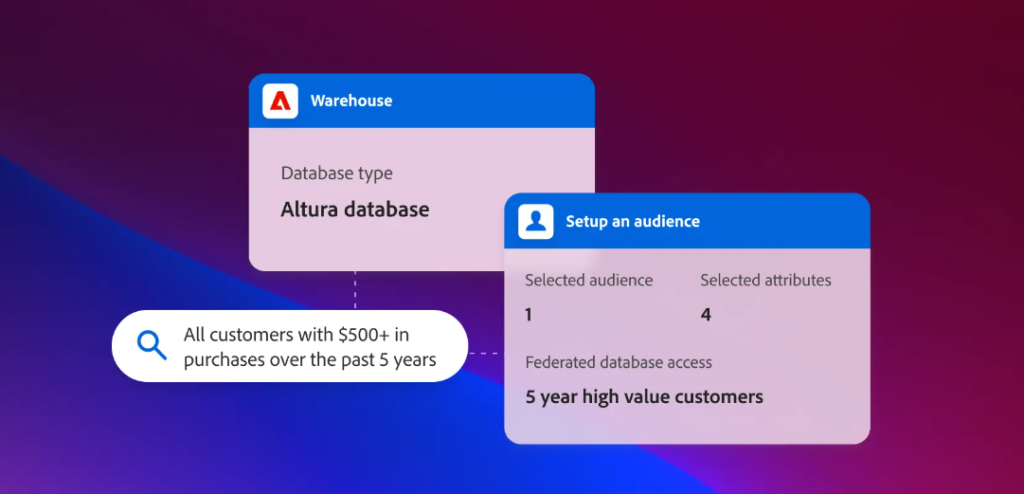

Despite having a huge amount of customer data available, gaps still exist as data is limited to activities within the bank’s environment. This is where the Terragon CDP offers banks an additional advantage as it provides data enrichment from its data marketplace which is powered by telcos, as well as online data from online publishers, which provides online behavioral patterns and browsing preferences. Combining this with aggregated data from customer touchpoints, CPaaS data provides unmatched and robust data that improves data accuracy which results in higher conversion, increased net promoter scores (NPS) and ensures customer loyalty and lifetime value.

“Identifying” the customer and delivering “personalized” engagements

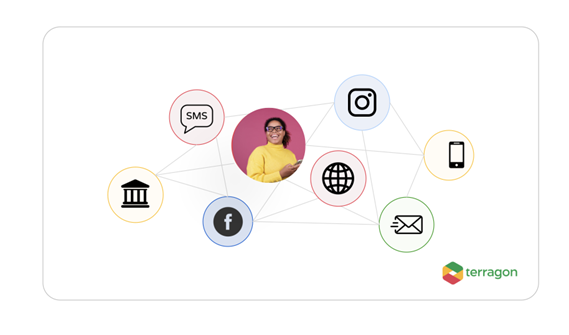

The customer journey is no longer linear as adoption of digital channels has resulted in customers having digital footprints across various platforms, starting a transaction via USSD, switching to mobile apps, visiting the webpage or using WhatsApp banking.

The CDP offers banks the flexibility to build persistent relevance irrespective of touchpoint and the stage of the customer journey to deliver relevant messages and the right time to delight the customer aka omnichannel journey orchestration.

According to a McKinsey report “Consumers don’t just want personalization, they demand it. With…loyalty more elusive, getting it right matters.” For banks which typically have fragmented data across various business units i.e. retail banking, agency banking, pension, insurance etc., the delivery of exceptional customer experience requires a robust CDP which unifies this disconnected data, in order to identify customers across various systems or platforms, carry out deep analytics to provide “actionable insights” needed by these business units to make informed business decisions, which are based on real-time data and insights. For instance, a customer who visits a particular page on the banks website or drops a comment on the banks social media page can be identified and sent relevant messaging or offering – such personalized engagements is what builds a deeper engagement and connection between banks and customers.

The combination of the value of both platforms is the ultimate game-changer for financial institutions as it provides them unprecedented data-driven marketing capability for, “intelligent” and omni-channel customer experience. As customers continue to embrace digital transformation banks must make smart technology investments which create meaningful and value-adding long-term relationships in order to stay ahead.

Terragon is Africa’s leading data and marketing technology company that leverages data and technology to help brands intelligently reach, engage and deliver more meaningful experiences to African consumers on mobile. Terragon has remained an ISO/IEC 27001 certified, 5 years in a row, a global certification for information security management systems, which indicates Terragon’s commitment to international standards on data privacy, data security and data protection. Terragon is the first and only African company listed as a certified CDP company by the globally renowned CDP Institute.