The power of customer data, analytics, and privacy-compliant personalization for financial services

July 31, 2023Companies today are under more pressure than ever to deliver better, more meaningfully personalized experiences to their customers.

But for financial services organizations to do so, they not only need to identify and unlock the power of their customer data, but they have to do so with privacy and compliance as their non-negotiable top priority. Unfortunately, many financial institutions are sitting idly on the data they need to power the kind of personalization customers want.

Per a recent Equifax study with Forrester Consulting, one-third of financial organizations are collecting data from common engagement channels (i.e. general transaction history, customer service data or online banking activity). But, because this wealth of data often becomes siloed or hard to access, less than 50% of banking providers are actually using this data to better understand customers and create relevant experiences.

So, what’s causing this disconnect between insight and impact? How do you bridge the gap? And how can financial institutions stay ahead of change, of customer expectations, and of competitors? A culture of data privacy, a data governance framework, and the right technology are key.

Bearing the weight of legacy systems in a changing financial landscape

Today, 40% of banking executives are extremely worried about the changing landscape of the industry, especially as many financial institutions continue to rely heavily on legacy systems.

Integration with a legacy stack is often a major challenge, and though many executives are hoping to adopt best-in-class technologies and practices to stay ahead of competitors, they often don’t know where to start, how to choose the right tools, or how to maximize their ROI. However, with the right technology and processes in place, bankers are better equipped to handle data, to create the most context-rich profiles of a customer and/or household, and to leverage credit profiles, income, wealth, purchase behaviors, and behavioral trends and patterns for a deep, meaningful understanding of each customer.

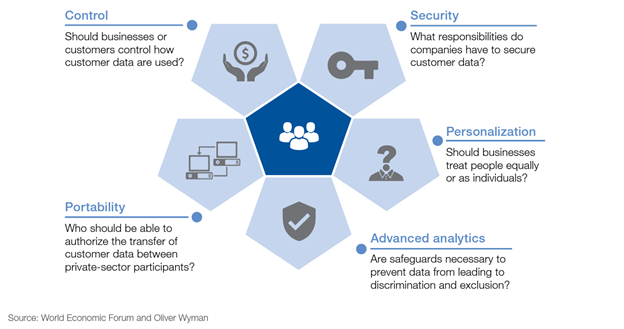

Beyond their tech stack, these institutions also have to consider a few key factors that can make or break the success of their data strategy and the impact of their personalization efforts. Per findings from the World Economic Forum, among the additional key considerations, should be:

- Control

- Security

- Portability

- Advanced analytics

Here are a few key questions to consider:

With these pillars guiding your strategy, it should be clearer to understand how to get started. But that doesn’t mean the road is free of pitfalls.

The roadblocks toward data-driven service excellence

When asked to prioritize their biggest challenges for data-driven marketing, 45% of financial institutions admit they have difficulty collecting and organizing data (Google Cloud). While they know that first-party data is valuable, many are collecting it without fully understanding what they have or how to use it, caused largely by:

- Data silos that prevent a holistic view of the customer and proper analysis

- Existing systems and decisions which don’t always produce actionable insights

- The lack of real-time updates and predictions which prohibit personalized audience targeting

- The use of legacy systems that don’t scale, integrate with new platforms, or meet the need for improved marketing performance

The solution? Extracting the value of your customer data — securely.

So, we understand the problem. Now, let’s talk solutions. Among the best, most comprehensive solutions to support a robust data strategy for financial services? Google Cloud says that’s a customer data platform (CDP): “Customer data platforms offer financial institutions insights from their data while helping maintain industry controls and security. One of the most important tools in achieving this is a cloud-based customer data platform that combines the right mix of first and third-party data, deep insights from analytics and AI, and the deft knowledge of both technical and non-technical teams across the organization.”

With agility, scale, and resilience top of mind, here are some ways financial services companies are leveraging CDPs to improve the customer experience and their business:

1. Richer customer and merchant profiling

A CDP can help financial services companies create detailed profiles of their customers by aggregating data from multiple siloed sources such as transactions, interactions, and demographic information. These profiles can be used to segment customers into different groups based on their behavior, preferences, interests and needs. For companies that are also selling through merchants (B2B), many CDPs can create profiles on merchants for account-based messaging and targeting.

2. Context-rich personalization

With the insights gained from a CDP, financial services companies can personalize their communication and marketing efforts to better meet their customers’ needs. This can include tailored offers and recommendations, as well as targeted messaging through various channels.

3. More cross-selling and upselling opportunities

A CDP can help financial services companies identify cross-selling and upselling opportunities by analyzing customer behavior and purchase history. This allows them to offer relevant products and services to customers who are most likely to be interested in them.

4. Fraud detection

A CDP can help financial services companies detect and prevent fraud by analyzing customer behavior patterns and identifying any unusual or suspicious activities.

5. Customer retention

A CDP can help financial services companies improve customer retention by identifying customers who are at risk of leaving and offering personalized solutions to address their concerns.

6. Empowered business users, equipped with data

A CDP is a key piece of data infrastructure for financial services companies because it provides a secure way for business users to access customer insights, create segments and activate data-driven campaigns. With a UI that is designed for business users to understand customer data and activate customer data, CDPs enable the last-mile of data-powered experiences and remove the bottleneck between meaningful access to customer data and intelligent activation.

7. Worry-free compliance

Financial services companies are highly regulated and require an additional layer of security, data governance and privacy protection. Financial services are also adopting CDPs to help enable improved data governance and compliance for security and privacy. This includes:

- Establishing a clear data governance policy that defines who has access to customer data, what data can be collected and used, how it can be stored and processed, and how customer data is deleted or anonymized when it is no longer needed.

- Implementing encryption, access controls, and other security measures that help prevent unauthorized access to customer data, and ensure that personally identifiable information is protected.

- Managing customer consent for data collection and usage, including providing clear and concise privacy notices, obtaining explicit consent for data collection and usage, and giving customers the ability to opt-out or revoke their consent at any time. Plus, by managing consent on each profile, CDPs can automatically create consent-based segments for suppression.

- Anonymizing customer data to protect privacy, which can involve hashing, removing or replacing identifiable information such as names, addresses, and phone numbers with pseudonyms or other anonymous identifiers.

- Complying with global and regional data privacy and residency regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). A few CDPs, like Lytics, can even provide their customer data software as a single-tenant solution, so there isn’t shared data infrastructure, and deploy it across regions.

Data and analytics: Financial services’ next, most valuable asset

In a privacy-first age, a robust, secure, and adaptable customer data platform is no longer just a nice-to-have business solution. It’s a competitive differentiator, and is slated to be financial institutions’ most valuable tool. According to J.D. Power’s 2022 U.S. Retail Banking Satisfaction Study, building a strong marketing analytics and first-party data backbone will be a digital finance marketing leader’s most valued asset to adapt to change.

But embracing a CDP isn’t just about addressing today’s business and customer experience challenges. It’s about arming your organization with the tools and technologies needed to go beyond simply modernizing an outdated stack and toward embracing the kind of innovation finance leaders aspire to.

Google Cloud perhaps put it best in a recent blog post, explaining: “Once data is in a secure, cloud-based data warehouse, then the cutting edge work really begins. With the data sourced, stored, and sorted, financial institutions can tap into AI and machine learning applications to gain fresh insights and build automated actions. AI platforms like Vertex AI give an entire organization the ability to create, deploy, and manage models faster and at scale. And an important feature for financial services is explainability, or the built-in ability to demonstrate the why behind models and predictions — which helps support the financial institution’s risk management and regulatory compliance.”

Ultimately, what we know is that insights from customer data can help financial institutions not just predict churn, determine lifetime value, and drive the next best actions that can help maximize benefits for both the customer and the company — but nurture customer relationships meaningfully across all the financial milestones in their lives.

This article was originally published on Lytics website. Click here to see the original blog post.