Decrease Risk Through Holistic View of Data

December 14, 2018Many data-savvy marketers and martech professionals think about how they can use data to create a competitive advantage. That’s crucial in today’s environment, where the more you show customers that you understand and value them, the better your marketing outcomes will be. But that’s not the only benefit of building the type of holistic view of customer data that allows marketers to deliver contextually relevant experiences and communications. There’s another, equally important, benefit: risk avoidance.

Privacy is paramount and ensuring it can be expensive if you have the wrong processes or systems in place. Whether put in place by federal, state or industry regulators, regulations such as GDPR loom large for marketers, as well as their entire organization. There are other business and technology risks that can be avoided by having robust customer data platform (CDP) capabilities. Decreasing risk by creating a comprehensive and accurate single customer view is a prudent and potentially profitable approach.

There are four primary ways to decrease risk through a customer data platform:

- Improve compliance through strong closed-loop processes, e.g. for GDPR,

- Increase data quality, and lower costs of maintaining customer data through advanced matching and streamlined Master Data Management (MDM),

- Improve cross-team collaboration, through connecting all data and making it accessible across the enterprise,

- Future proof your enterprise to enable innovative customer experiences via emerging technologies, through an open garden approach.

Think about how you currently access the data you need to optimize customer engagement. You may have robust demographic and purchase data in one system and rich online behavioral data in another. Your primary goal in bridging those silos may be to provide your frontline staff with access to the real-time data they need to provide the most relevant interactions, offers, or communications at each customer’s moments of truth.

Certainly, it’s essential to provide that access. But without the right tools and processes, you may be setting up a data free-for-all that leads to non-compliance with regulations, poor data quality and maintenance practices, and siloed operations.

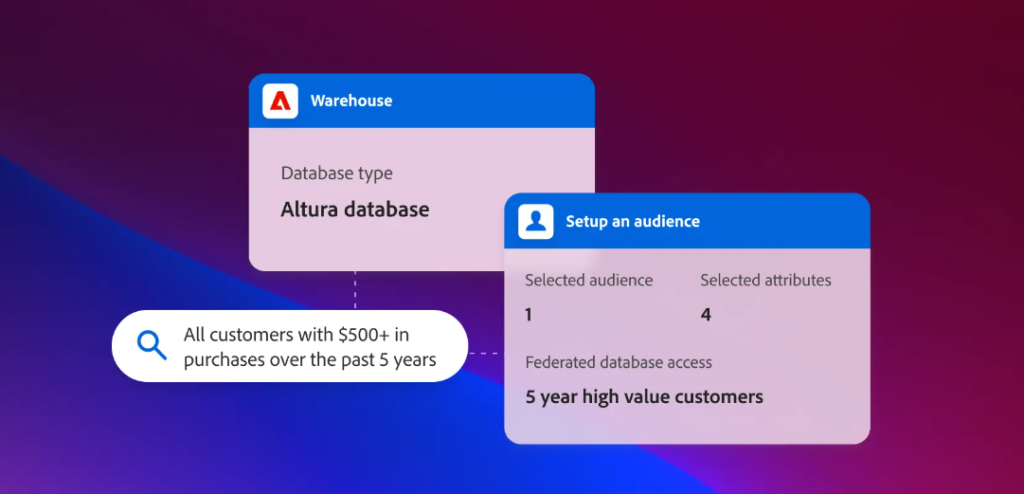

Creating a holistic view of customer data that solves these issues is easier, and more cost-effective, than you might think. The solution is a customer data platform. A CDP is a marketing technology that enables brands to integrate all types and formats of customer data (batch and streaming) to build a golden record of a customer or consumer — including anonymous-to-known behaviors, preferences, and purchase history. This not only enables you to hyper-personalize cross-channel customer interactions in real time, it also helps you to reduce the risks associated with siloed data.

Currently, only 48 percent of executives polled by systems integrator Dimension Data for its “Global Customer Experience Benchmarking Report” have a customer analytics system, and only 36 percent have a big data analytics solution in place. Companies embracing analytics and big data have a distinct advantage when it comes to both personalized customer experiences (CX) and risk avoidance.

Data access helps us to transform and innovate our marketing and CX, and as a result, reach new levels of marketing performance. But that access comes with its share of risks, including privacy, data quality, and fiefdoms. Using a CDP can help you reduce these risks. The key reason: CDPs connect all types and sources of customer data in real time, which creates a unified customer view that is accessible across the enterprise. This level of data access may at first seem too broad if it’s not what you’re used to. On the contrary, it provides a single point of control to effectively guard against privacy and quality issues. It also serves as bridge across data silos, which encourages data sharing and collaboration instead of guarded fiefdoms.

One of the biggest concerns in terms of managing the vast stores of customer data most marketers have at their disposal today is compliance risks. A CDP can lower these risks by helping you achieve compliance with regulations and industry mandates such as GDPR, HIPAA, PCI, and GLBA that focus on personally identifiable data.

Linking a CDP to a customer preference center is one way to decrease compliance risks. Providing a consent-based preference center for individuals allows them to select the exact ways they want their data accessed, processed, and forgotten. It should also enable them to set their preferences for communication across all interaction points along the customer journey. This creates a closed-loop process between data capture, preferences, and use. Along with reducing compliance risks, this approach will ensure that you’re delivering an excellent customer experience, one that’s personalized and delivers high value to consumers, so they opt-in rather than opt-out of your communications. That’s a marketing hat trick.

A CDP can also lower costs and reduce the efforts of maintaining and managing customer data. For example, using a CDP to automate manual data processes, Xanterra Parks & Resorts reduced the number of hours required to prep data by 80 percent. That efficiency not only reduces marketing costs, it also increases marketing performance by allowing Xanterra to get new communications and offers in market faster and enables its marketers to focus on higher-value activities. This overcomes traditional silos and takes the risk out of the complex process required to turn data into business value.

CDPs further help to guard against data quality issues. A CDP creates a singular, accurate, and continuously updated golden record of each customer through probabilistic and deterministic matching algorithms that is maintained with a persistent key. CDPs with streamlined MDM capabilities also ensure that as data is curated in creating precise customer and household views, there is proper data stewardship and governance in place to ensure quality. This solves customer identity challenges that are essential to risk avoidance and will quickly surface any data quality issues.

At a time when most data scientists spend 50 to 80 percent of their time prepping data, according to estimates by The New York Times, maintaining data quality to cut that prep time is more important than ever. And, as it turns out, is profitable: Research from Dun & Bradstreet and NetProspex shows that companies that regularly maintain their database can see 66 percent higher conversion rates than those that don’t.

The most important risk avoidance may be using CDPs to future proof your business, so you can continually innovate customer journeys in ways that take advantage of emerging technologies. This requires CDPs with an open garden approach that allow you to connect to new sources of data and new touchpoints in the future, including real-time engagement through mobile, social and Internet-of-Things (IoT) touchpoints. This effectively avoids the risks of becoming locked into technology that may otherwise prevent you from developing customer experiences that are competitively differentiated.

As an enterprise solution, a CDP can help you bring data together from across your organization, allowing you to know all that is knowable about your customers. You can then deliver relevant, personalized engagement across channels and interaction touchpoints. And just as importantly, it enables you to decrease the risks associated with managing volumes of customer data, improve data quality and maintenance, ensure compliance, and enhance collaboration — all while improving the customer experience and building a profitable competitive advantage.

There are four primary ways marketers and martech professionals can use a CDP to drive immediate and long-term business value. One is risk avoidance. The others are:

- Innovation – Increased market value through breakthrough innovations

- Revenue lift – Increased revenue through improved customer experience

- Operational effectiveness and efficiency – Decreased costs through improved operations and customer understanding

You can read more about innovation in “Increase Market Value Through Customer-Led Innovation,” about revenue lift in “Increase Revenue Through Improved Customer Experiences,” and about operational effectiveness and efficiency in “Decrease Costs through Improved Marketing Operations.”